RENTING VERSUS BUYING

How can we decide whether to rent or buy? It's clearly an individual decision and depends on many factors; both objective and subjective and some considerations that will be made by others, like a lender. or a landlord. A few of these objective factors are available funds for down payment and closing which is can be higher than first and last months rent + Security Deposit, usually equal to a months rent, credit history and Debt-To-Income ratio. On the subjective side are personal desires including how long you intend to live in the home - are you moving within 5 years to another location - available rental property that fits your needs as well as homes for sale that also fit your need and budget.

If you have considered buying your own home now may just be the time to make that happen! If you’re a renter concerned about rising rental prices, now may be the time to consider purchasing a home. There are a few good things to consider in this important decision.

.

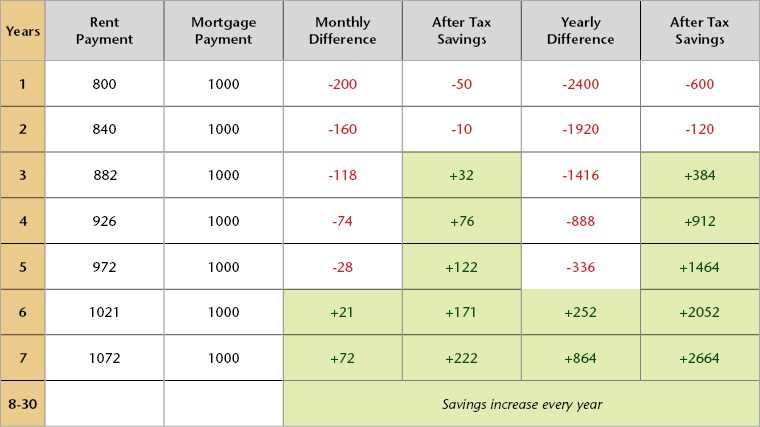

Comparison of Rent vs Buy Over a 7-Years

Let's look at the cash flow aspects of a Rent vs Buy Decision through a simple comparison. One important outcome of this is that it highlights why the time frame for how long you expect to be in a place makes a difference. The chart below shows the cash flow comparison for a renter and a homeowner over a 7 year period. The renter starts out paying $800 per month with annual increases of 5%. The homeowner purchases a home for $110,000 and pays a monthly mortgage of $1,000. After 6 years, the homeowner's payment is lower than the renter's monthly payment. After 3 years, with the tax savings of homeownership, the homeowner's net is less than the rental payment.

Source: Ginnie Mae